If you ran a small business in 2025 and felt like you were doing everything “right” but the math kept getting worse, you were not imagining it.

2025 was not a clean recession story. It was messier and, for a lot of operators, more frustrating: policy-driven cost pressure, a labor market that cooled without fully cracking, confidence that stayed depressed, and a credit market that priced uncertainty aggressively. Meanwhile, plenty of asset prices still looked great. That disconnect matters, because small businesses live in cash flow, not in narratives.

This post is a macro recap you can actually use, plus a practical 2026 outlook for owners who want to avoid getting stampeded into bad financing.

Tariffs: Trump’s obsession became policy — and 2025 was a generational shock

If there’s one thing Trump genuinely cares about, it’s tariffs. And in 2025, that obsession stopped being a campaign talking point and turned into the most explosive shift in U.S. tariff policy in nearly a century.

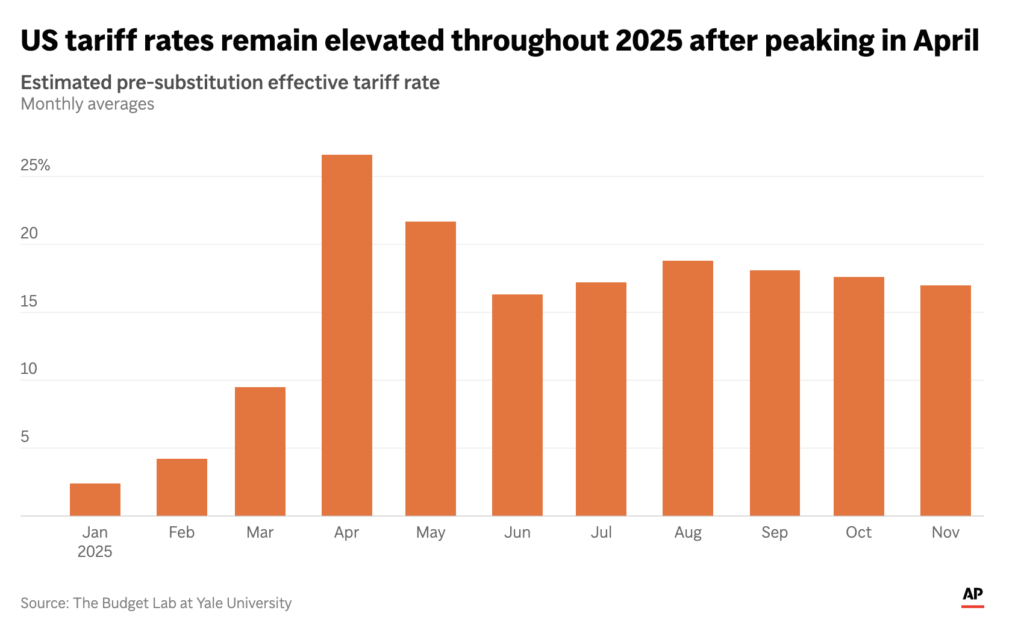

It started with “Liberation Day” (April 2, 2025) — a headline-grabbing reset that effectively rewired how the U.S. taxes imports. The immediate impact wasn’t subtle: tariffs jumped fast, businesses scrambled, and pricing assumptions that had been stable for years suddenly weren’t.

The bigger point is what happened after the initial spike. Tariffs didn’t just flare up and fade. They stayed elevated through the rest of the year, forcing businesses to operate in a new reality:

- Inventory got riskier (buy now at a known cost vs. wait and gamble on landed costs later)

- Supplier quotes got shorter and less reliable

- Margins got squeezed in categories where you can’t just raise prices without losing customers

- Planning horizons collapsed, especially for businesses with imported inputs, equipment, packaging, or consumer goods

This is why 2025 felt like a cost-squeeze year even when some inflation headlines looked calmer. A tariff regime change is not “inflation” in the way people casually use the term — it’s a direct policy-driven input shock. And when you combine higher input costs with uncertainty about where policy goes next, you get exactly what we saw: cautious hiring, cautious spending, and a lot more balance sheets snapping than most people want to admit.

Bankruptcies came back — and the small business signal is Subchapter V

One of the clearest signs that 2025 was tighter than the “everything is fine” narrative is this: bankruptcies re-accelerated.

Not in a neat, contained way where you can shrug and say, “That’s just overlevered tech,” or “That’s just one weird industry.” The pressure showed up across the system — including small businesses and households, not just big corporate restructurings.

The most telling small-business detail is the rise in Subchapter V filings — the bankruptcy track designed specifically for smaller companies to reorganize more efficiently. When Subchapter V starts climbing, it’s usually not because a few owners suddenly forgot how to run a business. It’s because a lot of operators are getting squeezed at the same time and need a formal mechanism to buy time, renegotiate obligations, or wind down in an orderly way.

And the mix matters. When you see:

- more businesses entering restructuring / liquidation processes, and

- more consumers resorting to bankruptcy protection,

it usually means the economy is running with less slack. People and companies are simply less able to absorb a bad quarter, a margin squeeze, or an unexpected spike in costs.

Tie that back to what you lived through in 2025: elevated input costs, financing that stayed expensive outside the “best borrower” bucket, and confidence that never really recovered. A lot of businesses weren’t borrowing to grow — they were borrowing to bridge. And bridging works until it doesn’t.

This is also why the tariff story isn’t just politics. A sustained cost shock doesn’t just raise prices — it compresses planning horizons. Inventory decisions get riskier. Supplier quotes get shorter. Cash cushions shrink. And once uncertainty becomes the norm, more balance sheets break — including the kinds of smaller businesses Subchapter V was built for.

The labor market cooled — first through hiring freezes, then through layoffs

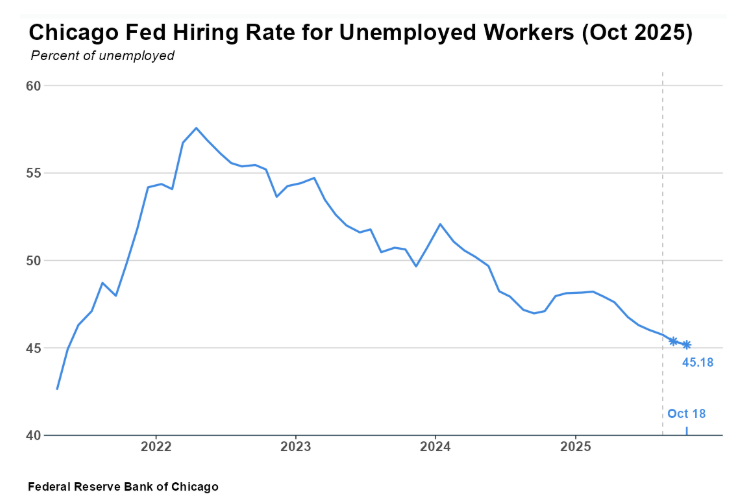

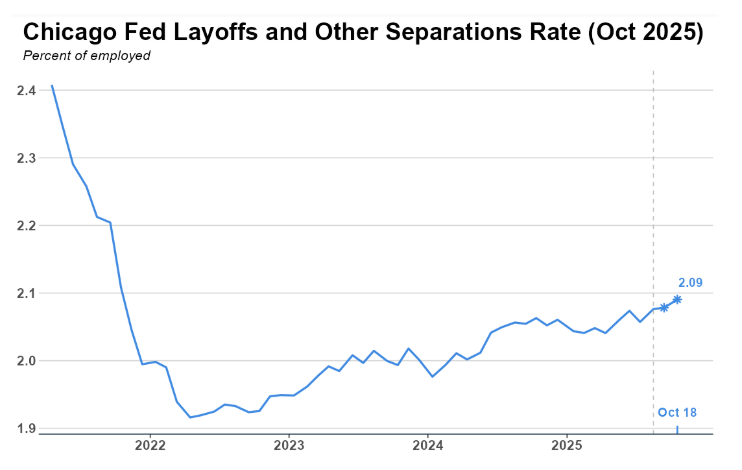

For most of 2025, the labor market didn’t “break.” It stalled.

Early on, the slowdown showed up in the quietest way possible: companies just stopped hiring. Open roles sat longer, backfills got delayed, and new headcount reqs turned into “let’s revisit next quarter.” It wasn’t panic. It was hesitation — the kind that spreads when margins get tighter and demand gets harder to forecast.

That’s the “no hire, no fire” phase: not many people getting fired, but a whole lot fewer people getting hired.

Then, in the back half of the year, the tone shifted with the unemployment rate reaching 4.6%, the highest in 4 years. You started to see more evidence of “no hire, more fire.” Not a layoff apocalypse — but enough incremental layoffs and separations to matter. The difference is psychological as much as statistical: once layoffs are back on the menu, confidence gets hit from both directions. Workers pull back spending. Employers get even more conservative. The cycle feeds itself.

There’s an extra layer here that’s hard to quantify cleanly but impossible to ignore: AI changed how companies think about marginal hiring. You don’t have to claim “AI replaced jobs” to see the behavioral shift. If leadership believes a mix of software + process changes can absorb some workload, the default becomes: don’t hire yet; see if we can run leaner. That alone can suppress hiring even before layoffs rise.

And for small businesses, this matters because the labor market isn’t just a jobs story — it’s a demand story. When hiring slows, growth expectations soften. When layoffs pick up, confidence takes another hit. In both cases, lenders don’t need a recession to reprice risk. They just need signs that the expansion engine is losing torque.

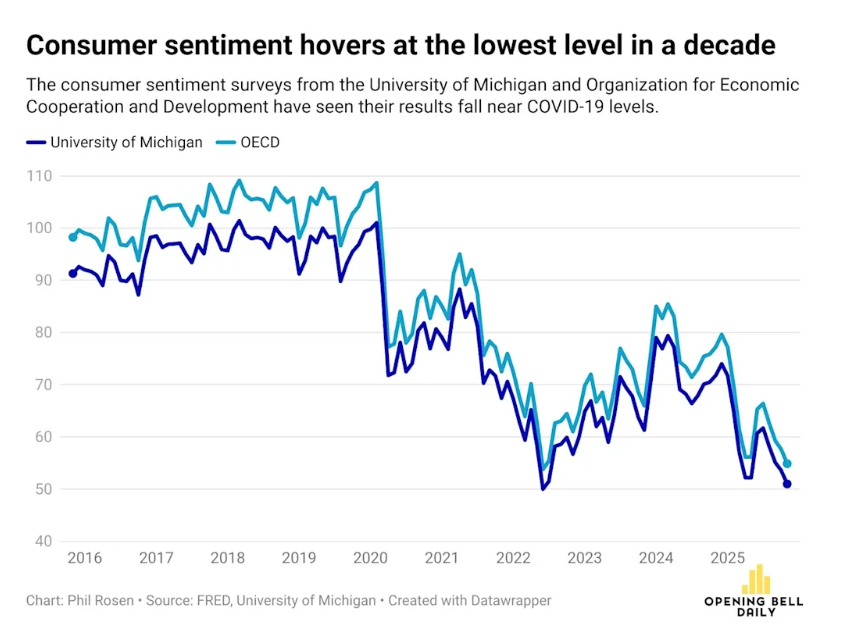

Consumer sentiment stayed depressed — and this is where the K-shaped economy shows its face

By late 2025, you could see the split in one glance: markets looked strong while consumers felt miserable.

Sentiment readings hovered near decade lows even as major stock indexes pushed toward record territory. That’s not just a quirky survey artifact — it’s a signal that a large chunk of households experienced 2025 as a grind: costs still felt high, wages didn’t feel like they were keeping up, and the job market didn’t feel as safe as it did a year or two ago.

This is also where the “K-shaped economy” becomes real instead of academic. If you own assets, have a stable salaried job, or sit higher up the income ladder, 2025 can look like a continuation of the post-COVID boom. If you don’t — or if your budget is dominated by rent, food, insurance, and debt payments (i.e. Affordability) — 2025 felt like a constant series of small punches.

And that split matters directly for small businesses, because consumer psychology shows up as behavior:

- More trade-down (cheaper alternatives, fewer add-ons, smaller basket sizes)

- More hesitation (longer decision cycles, weaker conversion rates)

- More volatility (strong weeks followed by inexplicable slowdowns)

So even if spending stayed “okay” in the aggregate, it often got shakier at the ground level — the exact level small businesses live on.

This is one of the underrated reasons borrowing got more dangerous in 2025. When consumer confidence is that weak, revenue becomes harder to forecast. And when revenue is harder to forecast, lenders don’t price you based on your best month — they price you based on the risk you’re about to hit a bad stretch.

What this meant for borrowing in 2025 (and why brokers had a great year)

When uncertainty rises, the financing market does two things fast:

- Banks stay the cheapest and stay slow.

- Fast capital gets more expensive because speed becomes a risk feature, not just a convenience feature.

That is why so many owners overpaid in 2025. Not because they were dumb. Because they were busy, stressed, and often needed money inside a timeline banks do not serve.

That is also why brokers thrive in years like 2025. Their pitch is always some version of “you have no other option.” The reality is usually: you have options, but you do not have time, and they are monetizing your urgency.

If you needed funding fast in 2025, the smarter move was almost always: apply direct to the right lender(s) and keep the middleman tax out of the deal unless you truly needed help packaging or navigating something specialized.

2026 outlook: bear case, base case, and the small business bull case

Nobody has certainty going into 2026, but we can outline reasonable scenarios.

The bear case (more of the same, with less patience)

- Tariff policy uncertainty continues, keeping costs jumpy and planning harder.

- Labor stays soft with uneven pockets of layoffs, which can hit demand and confidence.

- Sentiment remains depressed, so revenue volatility stays elevated.

- More balance sheets break, and bankruptcy remains a broad, “diffuse” story.

- The “mega” bear case factor in question: if AI is in a bubble and it pops.

The base case (slow improvement, still uneven)

- Some rate relief, some stabilization, still not a “back to 2019” world.

- Businesses keep operating lean and cautious, even if demand stabilizes.

The small business bull case (without taking a side)

There is a plausible upside story for 2026, especially if a few things line up:

1) A real rate-cutting cycle lowers the cost of money

The Fed cut rates multiple times in 2025, and internal divisions about the path forward are real. If rates continue falling, that can ease debt service, unlock refinancing, and improve cash flow for some operators.

2) Politics may push the “lower rates” narrative harder

Trump has been publicly pressuring the Fed and signaling a preference for a new chair aligned with lower rates, with reporting pointing to that as a stated priority ahead of 2026.

3) Tax changes could leave more cash in pockets

The IRS outlines provisions from the One, Big, Beautiful Bill Act taking effect for 2025 and beyond. If those provisions increase take-home pay for segments of consumers, that can support demand in certain categories.

4) Businesses adjust to AI, and productivity gains start to show up cleanly

If 2025 was “uncertainty about AI,” 2026 could be “processes finally redesigned around it.” That can reduce costs, increase output per employee, and eventually support hiring where demand exists. (This is a thesis, not a guarantee, but it is a real possibility.)

5) AI spending itself becomes a second-order tailwind

If the capex boom continues, there can be spillover demand into contractors, construction, services, logistics, and local ecosystems that support these buildouts. Goldman Sachs has highlighted the scale of potential AI investment going into 2026.

6) More certainty around tariff policy and supply chain adaptation

Even if tariffs stay higher than the old baseline, businesses can adapt once the rules stop changing every five minutes. Planning thrives on predictability.

Bottom line: there is a coherent bullish setup for 2026. It just does not arrive evenly, and it does not automatically help every small business. That is the point.

Practical advice for small business owners going into 2026

1) Treat urgency like a cost

If you need money in 7–14 days, you will pay for it. The only real way to reduce that cost is to plan earlier than you think you need to.

2) Be brutally honest about what the money is for

If financing is going to:

- cover losses

- fill a margin hole that is structural

- stack on top of existing daily/weekly payments

Then the “fast approval” is not the win. It is the trap.

3) If you can wait, use time as leverage

The best financing outcomes come from having time to compare real offers, not “pre-approvals,” and to understand total payback, fees, term, and effective APR.

4) If you cannot wait, go direct and control the process

If a broker is involved, ask a simple question: How are you getting paid, and how much? If the answer is fuzzy, that is the answer.

If you want a second set of eyes on your 2026 plan

If you Diogenes:

- your industry

- revenue range

- time in business

- whether you are profitable

- whether you already have any business debt

- how fast you need capital (if you do)

I will tell you, bluntly, whether borrowing makes sense at all, and if it does, what the least-damaging path looks like.

And if the right move is not borrowing, I will tell you that too.